Why did LUNA hit zero

This May, the world of crypto witnessed one of its biggest crashes ever. LUNA, the Terra native token, crashed to almost zero. The crash was of a huge magnitude and managed to wipe more than $40 Billion of investors’ wealth in a matter of days.

The crash resulted from the ill performance of the algorithmic stable coin, UST. It lost its peg to $1 and came crashing down to eventually land at less than a cent price. As a result, the Terra validators chose to halt the network, stopping the block production. Consequently, many exchanges delisted LUNA and UST to prevent traders from making losses by taking risky positions.

So, why exactly did LUNA crash? Follow along as we explore the LUNA crash in detail.

What is Terra LUNA?

LUNA is the native token of the Terra blockchain. TerraUST is an algorithmic stable coin that works following LUNA to maintain its price of $1. The UST token is linked to the US dollar, as most stable coins are linked to one fiat or the other.

Terra UST does not rely on a stored asset to derive its value, but instead generates it by following a set of rules. A certain amount of LUNA is burnt every time the price of UST falls under $1 so the price can recover. The opposite is done when the price crosses $1. Under this mechanism, the stable coin maintains its price.

Buy Terra LUNA Now

Your capital is at risk.

What Happened to Terra LUNA

As mentioned earlier, for TerraUST to maintain its peg to $1, it must be minted or burnt. So if you wish to buy TerraUST, you’ll have to mint them by paying a going rate through LUNA. These LUNA are then burnt, and consequently, the price of LUNA goes slightly up due to the supply contraction. This exact conversion method can also be applied to the coins in reverse.

Convert UST -> Mint LUNA -> UST gets burnt -> Price of UST goes up

Convert LUNA -> Mint UST -> LUNA gets burnt -> Price of LUNA goes up

A massive $285 million UST dump initiated a domino effect of shorting the asset. While the initial dump was pretty significant, it was complemented by multiple dumps of a considerable magnitude as the news took Twitter by storm. As a result, the price of both UST and LUNA started showing a downward trend.

To stabilize the UST peg, Terraform foundation liquidated all of its 40k Bitcoin holdings. Sidenote – Terraform foundation was among the top 10 holders of BTC. Due to this, the price of Bitcoin witnessed a sudden fall as well. By 12th May, the price reached a 10-month low of $26,350.49. This behavior was parallel across most cryptocurrencies, and the crypto markets were a host of red candles.

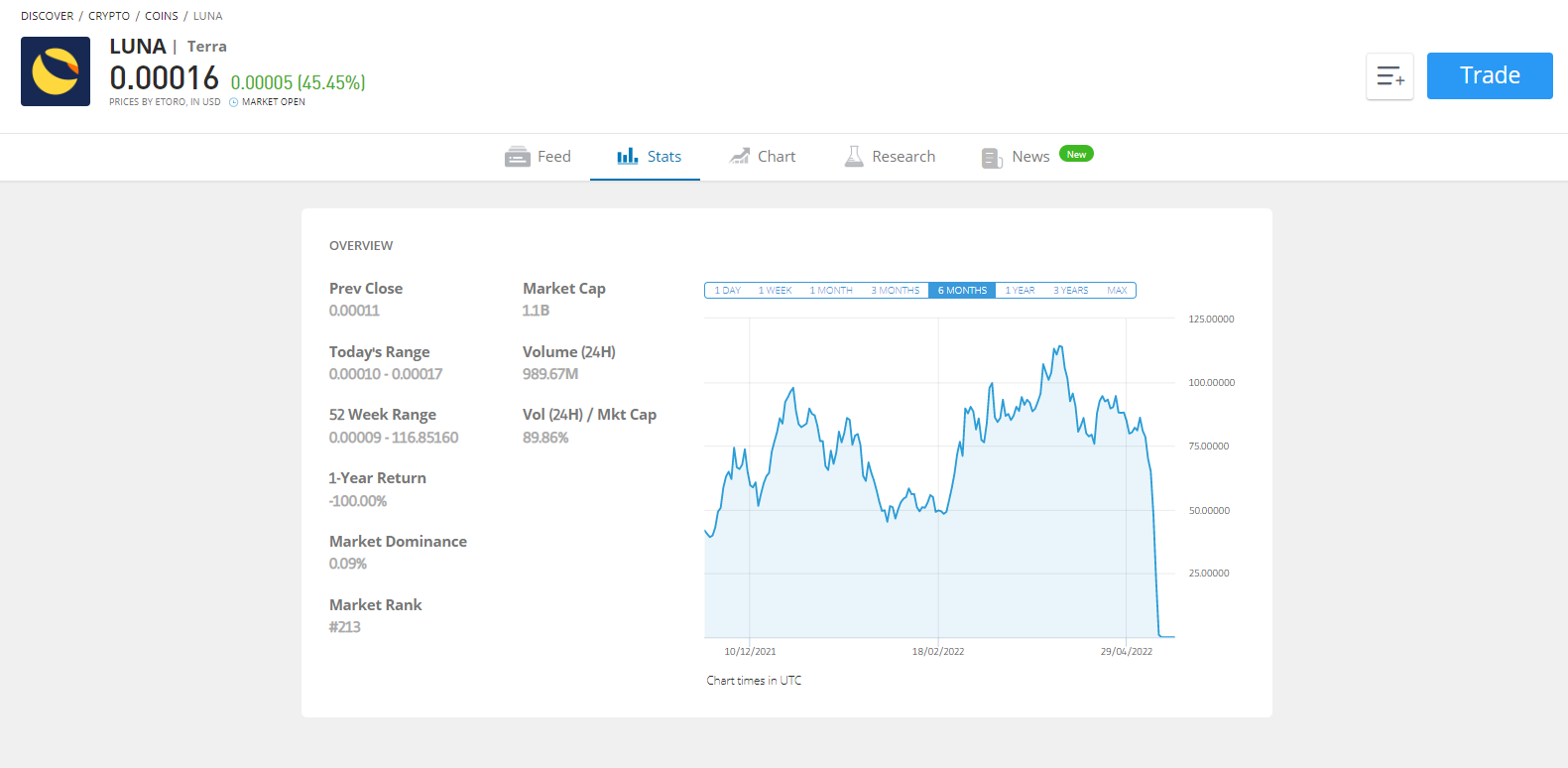

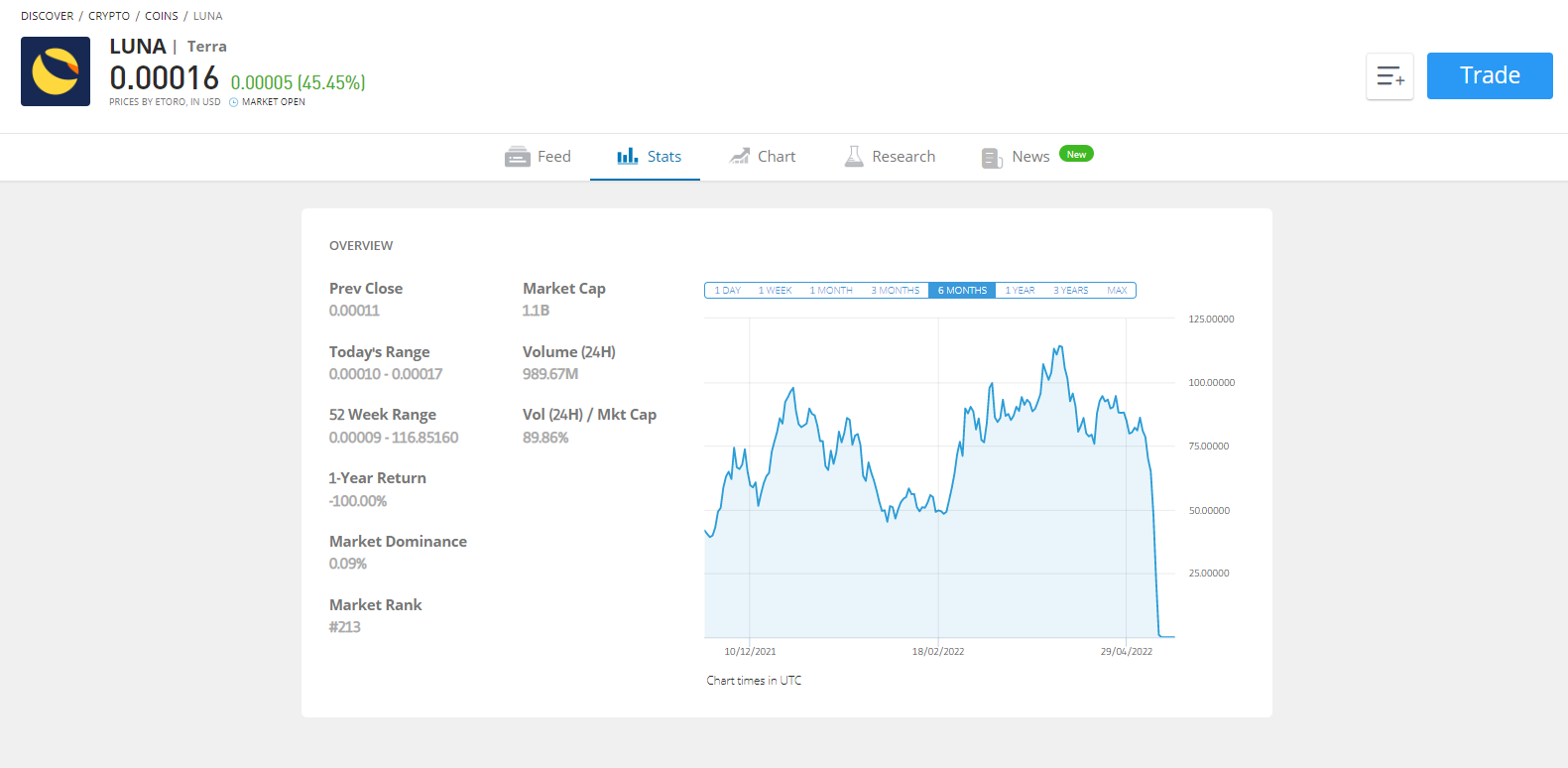

The overall crypto market bleeding supplemented the already plummeting price of LUNA, and it fell below a dollar after its ATH of $119 last month. Soon after, the price of LUNA fell by 99% multiple times, eventually landing at an all-time low of $0.00001675, almost zero.

Last month, at its all-time high, the market cap of LUNA stood at a whopping $40 Billion. However, it stands at a mere $979 million at the time of writing. The crash managed to wipe almost 40 billion dollars off investors’ pockets.

Hyperinflation of the Terra and LUNA supply was the major cause of the fall in prices. Before the crash, there were 350 million LUNA tokens in existence, while after the crash, it rose to 6.9 Trillion. The increase in supply is, to a certain extent, unexplainable.

eToro platform has again listed LUNA after brief delisting

Amidst this crypto crisis, many exchanges choose to delist or halt the trading of LUNA and UST. Binance and Crypto.com were among the few platforms to halt the trading of LUNA. eToro too, chose to delist the token at the same time. As of now, however, LUNA is available for trade on eToro.

Massive shorting, failure of UST to maintain stability, market sentiment, the halting of trade, and a few other minor reasons were all it took to make the LUNA crash happen. The token currently trades at $0.00015 and remains fairly volatile.

It may not be the best asset to trade right now, assuming the risk involved. But if you still wish to trade, you can do it on eToro. The platform charges zero transaction fees and accepts multiple payment methods to make a fiat deposit. Make informed decisions.

Read more:

Lucky Block – Our Recommended Crypto of 2022

- New Crypto Games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- Worldwide Competitions with Play to Earn Rewards

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Draws for Holders

- Passive Income Rewards

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in May 2022

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.