US Bitcoin Supply Dominance Falters As BTC Moves to Asia en Masse, According to Crypto Analytics Firm Glassnode

Crypto analytics platform Glassnode says that the regional distribution of Bitcoin (BTC) is seeing notable transformation amid changing investor behaviors.

The firm says that the dominance of US entities in the Bitcoin market, which peaked between the years 2020 and 2021, is seeing a significant decline since around the time the price of BTC saw a massive drop last year.

A clear divergence is visible in the year-over-year BTC supply change based on geographical regions. The extreme dominance of US entities in 2020-21 has clearly reversed, with US supply dominance falling by 11% since mid-2022.

Bitcoin supply in the US region is down by 11% while those in the European Union (EU) region and Asian region are up by 1.1% and 9.9%, respectively.

According to Glassnode, the BTC supply dominance reversed as Asian traders became more invested in the Bitcoin market.

European markets have been fairly neutral over the last year, whilst a significant increase in supply dominance is visible across Asian trading hours.

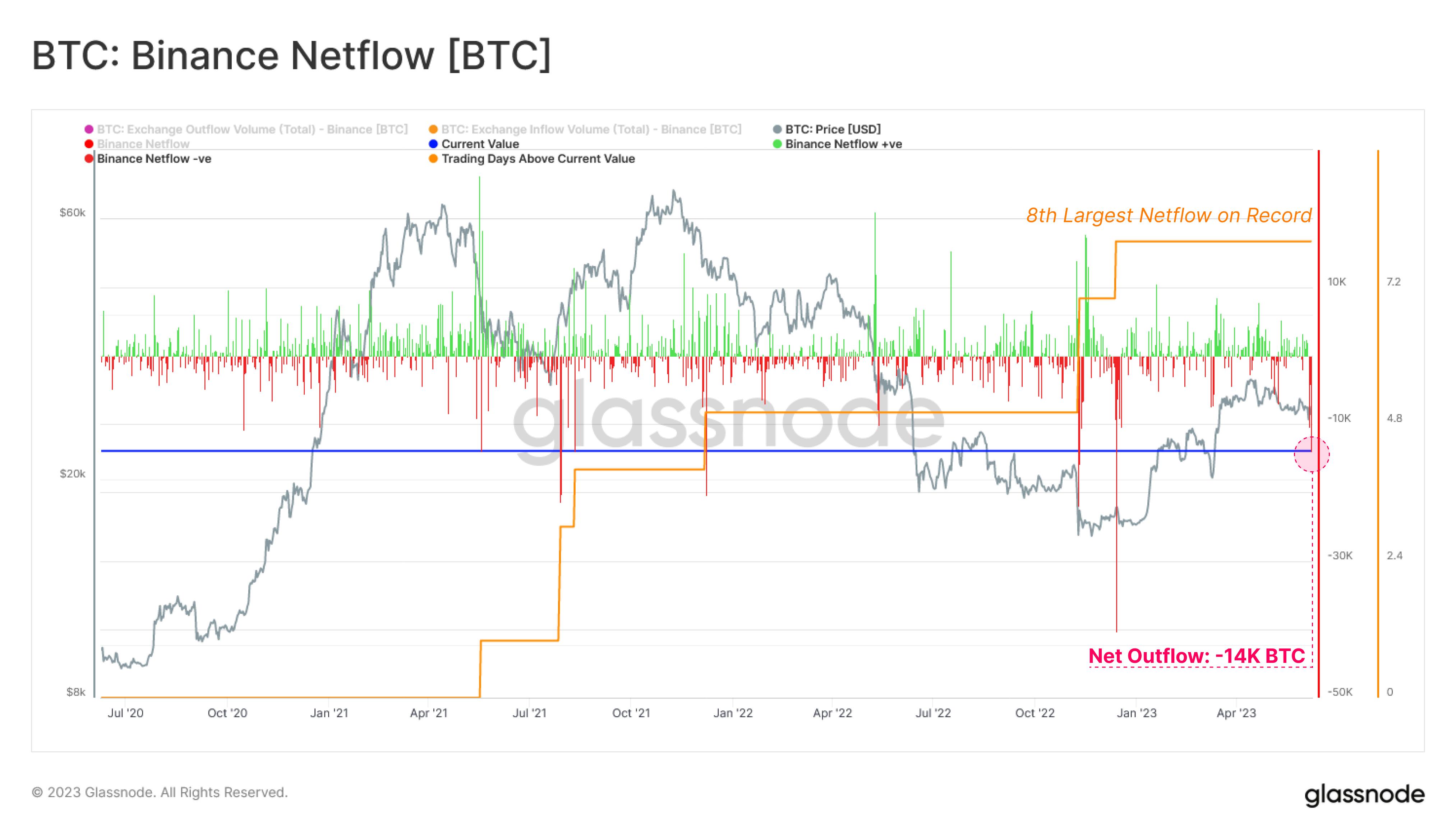

Glassnode also reports that leading crypto exchange Binance, which was recently hit with 13 charges in the US, is seeing large outflows in Bitcoin.

Binance continues to experience Bitcoin net outflows following the news of SEC charges, recording the 8th largest net outflow on record of -14k BTC.

Don’t Miss a Beat Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Check Latest News Headlines

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

This article was originally reported on The Daily Hodl.