Net Flows Suggest Bullish Crypto Market Momentum: Bank of America

The Bank of America has concluded that the recent rise in crypto outflows from exchanges and a rise in stablecoin net inflows signal “bullish” market momentum.

In the July edition of its Global Cryptocurrencies and Digital Assets report, the bank went as far as to say that “fading sell pressure” has now turned to “buying.”

This change in sentiment can also be seen in an 11% rise in the digital asset market between June 29 and July 26, despite recording a 56% downtrend year-to-date.

“Investors are moving off of the sidelines as risk assets rally. Tight supply and continuous exchange net outflows indicate that investors continue to HODL,” the report reads.

Whats more striking is that the recent positive price action comes in the wake of exceptionally high CPI numbers and the Federal Reserves decision to undertake its greatest rate hike in 20 years.

Despite this, Bank of America suggests that investors have acclimated to the current macroeconomic turbulence and are ready to venture back into risk-on territory.

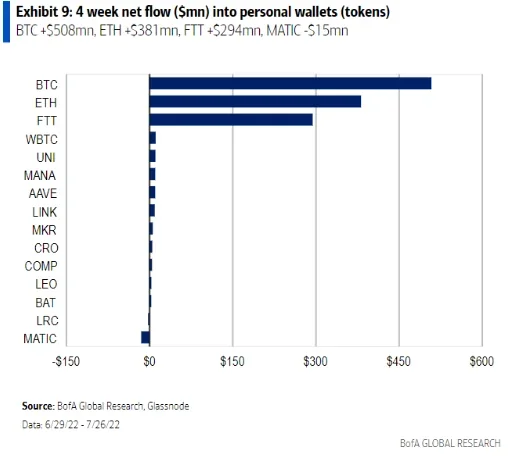

Bitcoin, Ethereum, and FTXs native token FTT have all experienced hefty inflows to wallets and away from crypto exchanges.

This is often understood as a bullish signal because investors typically move assets off of exchanges when they are simply interested in holding the asset (rather than selling).

When examining Bitcoin, for example, the leading cryptocurrency recorded a whopping $508 million in outflows from exchanges over the past month. In that same period, it recorded a 19% increase, jumping from $19,300 on July 2 to $23,160 on August 1.

Likewise, Ethereum enjoyed net inflows of $381 million, which coincided with a run-up of more than 56%, according to CoinMarketCap.

Uptick in stablecoin

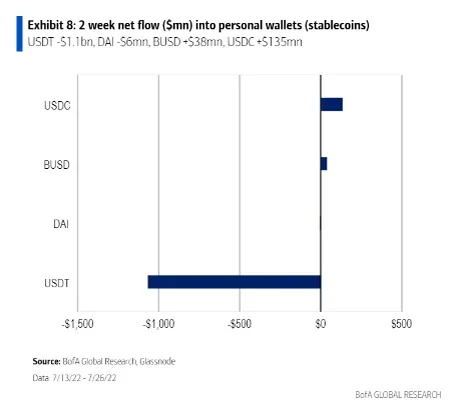

The top four stablecoins by market capitalization (USDT, USDC, BUSD, and DAI) have experienced three consecutive weeks of net inflows totaling $1.4 billion.

Unlike inflows to exchanges from volatile cryptocurrencies, like Bitcoin or Ethereum, the inflow to exchanges from stablecoins could be understood as bullish.

This is because stable, dollar-pegged assets arriving on an exchange indicate investors are entering the market looking to buy.

Over the past nine weeks, stablecoin inflows and outflows have alternated, with the most recent noticeable surge in outflows of $437 million, occurring during the end of June and start of July.

Stablecoin outflows to personal wallets from exchanges occur when investors are looking to protect the dollar value of their assets; this is often the case during periods of downward price movements across the crypto space.

However, when investors are looking to expand their risk appetites, they typically look to spend their stablecoins to reinvest in more lucrative assets.

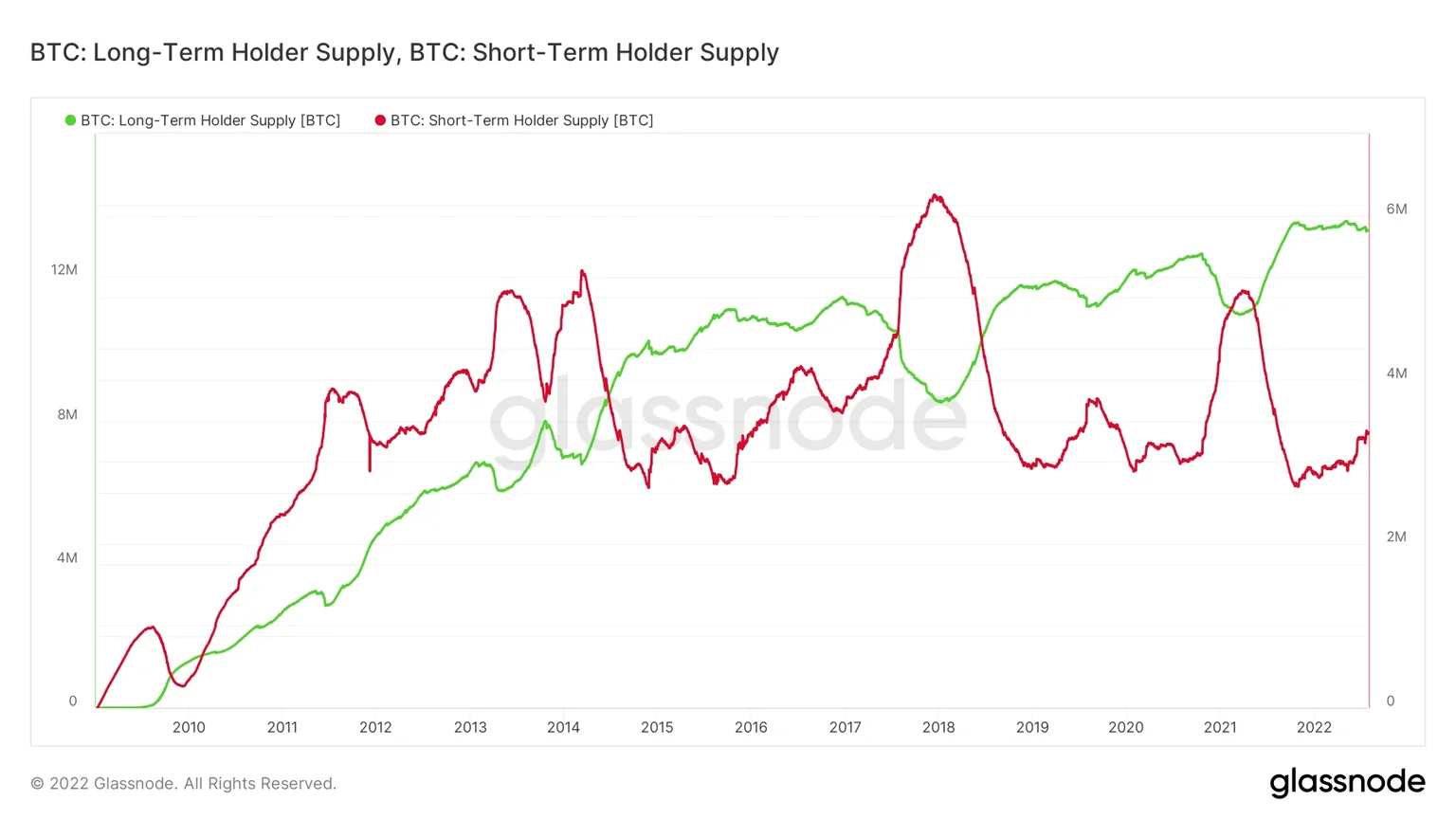

Turning to on-chain data from Glassnode, both long-term holders and short-term holders are also actively purchasing Bitcoin.

Over the past two weeks, short-term holders, in particular, have developed an appetite for Bitcoin, indicating that this “bullish” momentum may be short-lived.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.