Liquidity Pools in Decentralized Finance (DeFi) – Explained

Decentralized finance aims at the decentralization of conventional financial services such as lending, borrowing, and exchanges. Over the course of time in recent years, DeFi protocols have achieved formidable popularity. Interestingly, a major share of the growth of DeFi points towards the decentralization of liquidity by leveraging global liquidity pools.

Decentralized exchanges, synthetic assets, yield farming, borrow-lend protocols, and on-chain insurance utilize the concept of liquidity pooling effectively. In the case of conventional finance, a centralized organization like banks offers liquidity. On the other hand, market makers offer liquidity for cryptocurrency exchanges.

There is no doubt that DeFi has sparked staggering levels of growth in on-chain activity. Interestingly, the volumes of transactions on decentralized exchanges or DEXs could easily compete with centralized exchanges. With around 15 billion dollars of value locked in the DeFi protocols, the DeFi system is expanding continuously. The following discussion will help you discover the value of liquidity pools in DeFi ecosystem.

Learn the basic and advanced concepts of DeFi. Enroll Now in DeFi Course

What is Liquidity Pool?

One of the foremost things that come to mind when thinking of liquidity pools is their definition. It is basically an assortment of funds locked within a smart contract. Liquidity pool could facilitate different types of transactions such as decentralized lending and trading along with many other functions. They are the foundation of various types of decentralized exchanges or DEXs like Uniswap.

Some users referred to as liquidity providers could add the equivalent value of two tokens in a specific pool for creating a market. Liquidity providers could earn the trading fees from all transactions carried out in their pool. Interestingly, the trading fees depend directly on their share in the total liquidity. The easier process of becoming a liquidity provider has also improved the accessibility of market-making with Automated Market Makers or AMMs.

The first-ever protocol in using liquidity pools DeFi, Bancor, established the foundation for the growing interest in the concept of the liquidity pool. However, Uniswap played a crucial role in driving more popularity for the liquidity pool concept. Some of the notable exchanges using liquidity pools on Ethereum include Balancer, SushiSwap, and Curve. The exchanges utilize ERC-20 tokens. Similarly, you can also find BurgerSwap, Binance Smart Chain (BSC), BakerySwap, and PancakeSwap with BEP-20 tokens as other alternatives of liquidity pools.

Must Read: The Ultimate Guide For DeFi KYC

The Necessity of Liquidity Pool

The next critical factor in understanding the value of liquidity pools explained clearly is the necessity of liquidity pools. Similar to conventional stock exchanges, centralized crypto exchanges follow the Order Book model, which enables buyers and sellers to place orders. In the Order Book model, buyers aim at purchasing an asset at the lowest possible price, while sellers focus on selling the asset at the maximum price possible.

Now, the buyer and the seller should agree on the price for a successful trade. However, you can encounter some setbacks when the seller and the buyer cannot reach an agreement regarding the price. In addition, the concern of liquidity also presents obstacles in the execution of the trade. Market Makers find a perfect window in this case and ensure trading by placing commitments for purchasing or selling a specific asset. As a result, they could offer liquidity.

Apart from offering liquidity, Market Makers could also help traders in carrying out transactions without waiting for other buyers or sellers. However, relying excessively on external market makers could lead to extremely slow and expensive transactions. The concept of liquidity pools in DeFi could play a conclusive role in addressing these problems.

Curious to understand how Defi works? Check out this detailed article on How Does Decentralized Finance Works?

Working of Liquidity Pools

The most significant aspect in answers to what is liquidity pool would obviously point out to their working. Automated market makers have emerged as a formidable factor in changing the conventional approaches for trading crypto assets. AMMs have evolved as an innovative drive for enabling on-chain trading without any order book. Without any direct counterparty for the execution of the trades, you can easily get in and out of positions on token pairs.

AMMs ensure better flexibility for trading in token pairs, which are considerably illiquid on exchanges following the order book model. Order book exchanges allow peer-to-peer transactions with connections between buyers and sellers through the order book. However, AMM trading is different as it focuses on the interaction between peers and contracts.

Liquidity pools are basically a collection of funds deposited by liquidity providers into a smart contract. AMM trades do not involve any counterparty, and users have to carry out the trade with respect to liquidity. If the buyer wants to buy, they dont have to rely on a seller at the specific moment. On the contrary, adequate liquidity in the pool could support the execution of the trade.

You dont have a seller on the other side when you purchase the latest food coin on Uniswap. As a matter of fact, an algorithm manages the whole transaction alongside taking care of governance of the pool. Furthermore, the algorithm also leverages information about different trades in the pool, thereby playing a significant role in pricing.

Another interesting fact about liquidity pools DeFi is the feasibility for anyone to become a liquidity provider. Therefore, it is reasonable to assume liquidity providers as the counterparty in such cases without exact similarities with the order book model.

Looking for some resources to learn about algorithmic stablecoins? Here is a detailed article to know about the algorithmic stablecoins and their types!

Uses of Liquidity Pools

Many of the best liquidity pools gained popularity in 2020. As of now, Uniswap is the most popular decentralized exchange credited for operations of some of the biggest liquidity pools. Interestingly, the USD-ETH pool has almost $250 million locked in it. Some of the other notable pools you can find on Uniswap include ETH-USDT, WBTC-ETH, and DAI-ETH. As noted previously, Balancer, SushiSwap, and Curve Finance are also some of the exchanges using DeFi liquidity pools.

Balancer provides support for almost eight tokens in a pool, while Curve pools provide multi-token support with a specific focus on stablecoins. On the other hand, SushiSwap basically serves as a virtual clone of Uniswap. With so many promising applications of the liquidity pool concept, it is reasonable to wonder about their other promising uses. Since liquidity pooling is quite a simple concept, you can use it in many other ways.

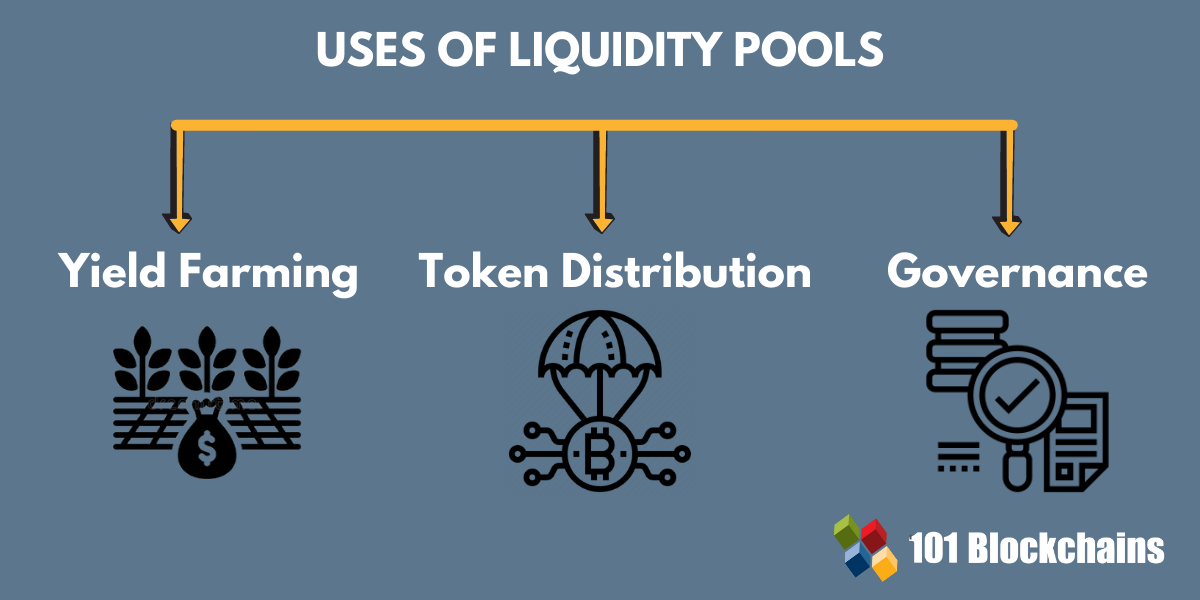

The first interesting use case explained clearly focuses on liquidity mining or yield farming. Liquidity pooling offers the foundation for automated yield-generating platforms such as Yearn Finance. Users could add their funds in pools on these platforms, which are used later for generating yield.

Want to learn blockchain for free? Enroll Now:Enterprise Blockchains Fundamentals Free Course

Liquidity mining also presents a productive solution for the distribution of new tokens to the right people in different crypto projects. The algorithmic distribution of tokens to users who have placed their tokens in liquidity pool provides better efficiency. Subsequently, the newly minted tokens are distributed according to the share of each user in the liquidity pool.

However, it is important to remember that such tokens could also come from other liquidity pools, also referred to as pool tokens. For instance, users lending funds to Compound or offering liquidity to Uniswap would get the tokens representing their share. You could deposit the tokens in another pool to earn viable returns.

The best liquidity pools could also serve as helpful instruments in governance. You could discover a potentially higher threshold of token votes required for establishing a formal proposal for governance. However, pooling funds together as an alternative could help participants rally behind a common cause perceived as significant for protocol.

Some of the other applications of liquidity pools in DeFi ecosystem include safeguards against smart contract risks and tranching. Many DeFi implementations leverage the liquidity pool concept for safety from smart contract risks. Liquidity pools also support tranching or division of financial products according to risks and returns associated with them. Interestingly, the products could help liquidity providers with a selection of customized risk and return profiles.

Want to become a DeFi expert? Check out our detailed article on How To Become A DeFi Expert?

Setbacks in Liquidity Pool Concept

The final aspect in any discussion on liquidity pools explained properly refers to the risks associated with them. One of the foremost risks you can find with the liquidity pool is impermanent losses. Liquidity pooling leads to temporary loss of funds of the liquidity providers due to the volatility in a trading pair.

The pools trading activity has a formidable impact on the pricing of the asset. In case of variation of the assets price with respect to the global market price, arbitrage traders could use it to their advantage. In addition, pricing algorithms in liquidity pooling could also lead to concerns of slippage for smaller pools.

Learn Decentralized Finance (DeFi) Concepts with DeFi flashcards!

Bottom Line

Liquidity pools are the foremost innovative technological intervention in the crypto space in recent times. They play a crucial role in driving the feasibility of the existing DeFi technology stack. Liquidity pooling could also foster a wide range of use cases in the DeFi landscape, including decentralized trading, yield farming, lending, and many others.

Liquidity pool could offer improved accessibility and yield farming opportunities alongside opening up new avenues in DeFi use cases. On the other hand, they also present some risks such as impermanent loss and excessive dependence on smart contracts. In the long run, liquidity pooling would shape up the DeFi ecosystem with new and sophisticated solutions. Learn more about DeFi and liquidity pooling in detail for exploring their actual value.

Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. Do your own research!

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1319120831554152’);

fbq(‘track’, ‘PageView’);