How DeFi has contributed to its own collapse by ignoring security and using poor tokenomics

Join Our Telegram channel to stay up to date on breaking news coverage

Early in 2021, decentralized finance (DeFi) drove the explosive expansion of cryptocurrencies, but since then, the value of the crypto market has collapsed. Global markets and developers’ carelessness with regard to cybersecurity and (sometimes self-serving) inflationary token structures have both played a part.

Too much DeFi has been built on tokens created out of thin air or tokens that lend money to other tokens at excessive interest rates, with little actual economic activity to support the yields promised.

Second, there have been several security flaws, hacks, and exploits of DeFi contracts and bridges, and the majority of well-known DeFi platforms have been the victim of an exploit.

Last but not least, DeFi is only supported by native smart contract platforms and tools due to the absence of a unified standard for defining DeFi contracts. This constrains DeFi’s potential for expansion, universal client support, and, eventually, acceptance.

DeFi is most likely here to stay despite these setbacks. To be truly useful, it will need to undergo modifications and advancements.

Too many harvests that are not sustainable and too much “minting”

Several enterprises that promised returns but were not supported by any actual economic activity arose during the DeFi summer of 2021. Some of the yields had rates as high as 800%, and many of them were repaid by creating more of the same tokens at random.

In essence, this setup produced a system that needed a growing number of new consumers to generate demand. Only if new people continued to join in could the yields be maintained, which is a classic feature of a pyramid scheme. Eventually, a number of DeFi businesses (Terra, Voyager, Celsius, and 3AC, to name a few) that offered tokens with high yields experienced catastrophic collapses. DeFi’s future is probably not in tokens that guarantee returns that aren’t supported by actual economic activity outside of token production.

Priority has not been given to cybersecurity

The enormous number of projects that experienced external or internal hacking of their reserves or users was another aspect of the DeFi summer. Examples include the Binance Smart Chain, the Ronin network, Polygon, Blizzard, Wormhole, and Meter Bridge (BSC). To put it plainly, some of the hacks showed poor security procedures.

It took days or weeks for someone to identify or disclose a breach, which resulted in several projects losing a significant amount of their reserves. Protocols that were coded to transfer value without checking account balances are another example. Additionally, there were instances where protocols were weakened by programmers whom the operators reportedly hired without properly verifying their credentials. These sad events might serve as teaching opportunities for the neighborhood.

Along with more thorough and careful vetting and development, turning to fundamental security procedures like independent system monitoring and alarms would be advantageous. Future DeFi projects that succeed will be those that take a more fundamental and principled approach to security while taking lessons from the problems and events of DeFi’s early years.

DeFi should be redefined to finance actual economic activity

The potential of blockchain technology to expand financial inclusion of the unbanked and underbanked is one of its lauded and anticipated advantages. This holds enormous potential for community development and improvement.

To date, though, it has been a lost chance. By designing these products around the borrowing, lending, and shuffling of crypto tokens, DeFi has largely concentrated on financial goods for those who are already members of the crypto community. By addressing the goals of the underbanked in the actual world, DeFi’s development would be aided.

“Buy now, pay later” (BNPL) DeFi products are starting to appear by taking advantage of the capability to tokenize real-world goods utilizing standards similar to ERC-721 for nonfungible tokens (NFTs). Some of these products are based on loans to finance tokenized real-world goods, like smartphones used as work tools, and more lately, even mortgage financing.

The DeFi products are based on the actual returns possible for such financial transactions, are secured by those real-world objects, and are able to support a decentralized collection of agents and clients. There will probably continue to be an increase in the number of products created to address underbanked communities and real-world financial objectives.

Create a representational standard for DeFi contracts

Growth can be significantly accelerated by standards. For instance, the ERC-20 standard aided the creation of fungible tokens by making them simpler to understand across many platforms and applications. A user can handle ERC-20 tokens with clients created by companies outside of Ethereum, BSC, or Avalanche, for example, and they can be defined on any of those platforms.

Such clients include, for instance, MetaMask, Brave, or really any client that implements the ERC-20 standard. This has made it possible for several advances, including the bridging of tokens between platforms. Similar to this, the ERC-721 standard has sped up the development of nonfungible tokens by enabling users to manage NFTs on a variety of platforms and clients.

Similar outcomes are probably possible with a standard for describing decentralized financing for end users. One benefit is that it will make it possible for different development teams and projects to represent DeFi products in a uniform way, which would eliminate a lot of ad hoc coding and interpretation of DeFi contracts and goals. Users will be able to manage their DeFi equipment using a variety of clients and browsers that are compliant. In addition to potentially allowing portability of DeFi products across platforms, this would also involve automatic repayment for DeFi loans or lines of credit.

Establish a standard for DeFi contracts

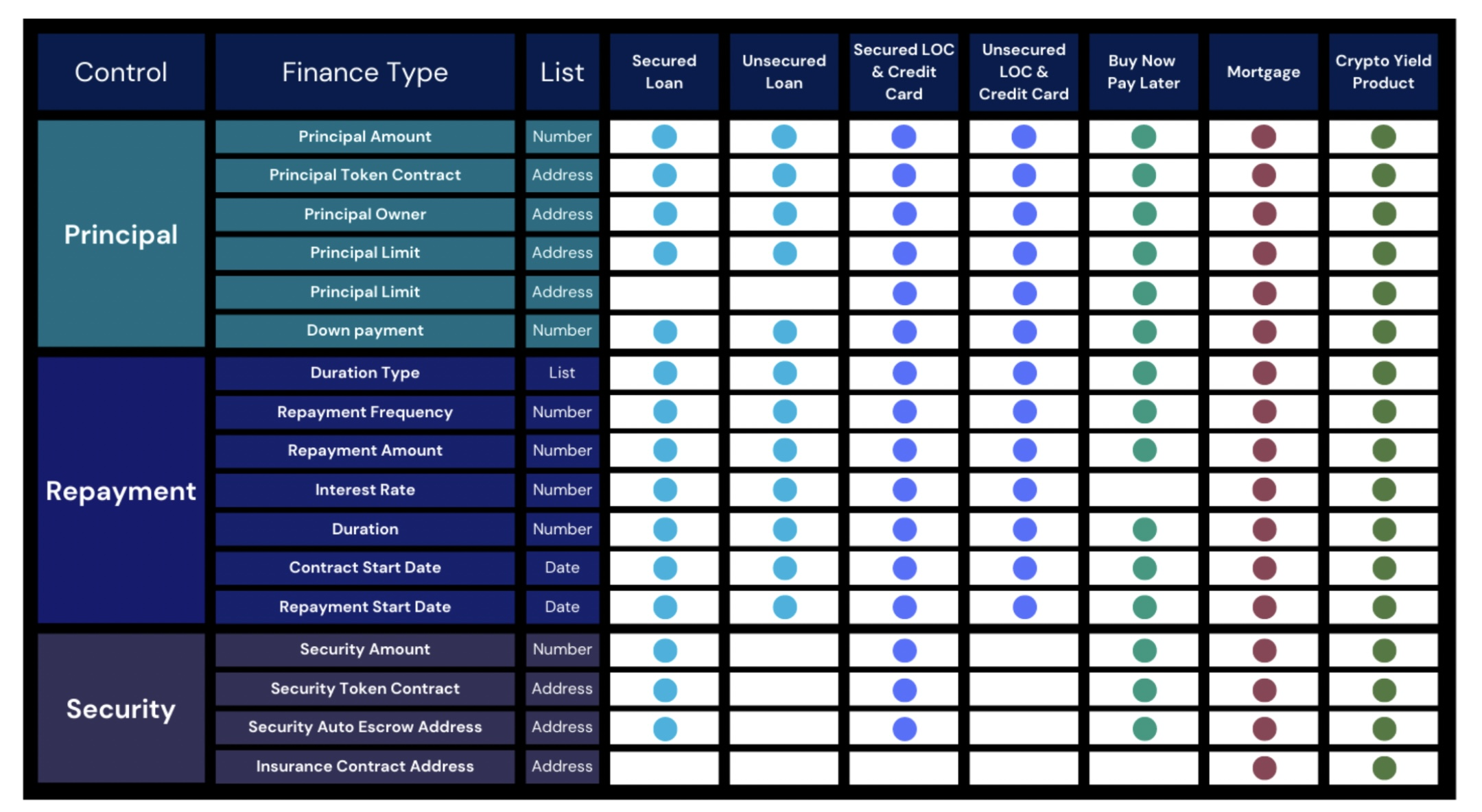

A DeFi standard would unavoidably need to be comprehensive enough to define numerous DeFi product types. This would include DeFi mortgages, lines of credit, BNPL contracts, secured and unsecured DeFi loans, and even the widely used crypto yield products at the moment.

This standard’s definition allows it to be used to any DeFi contract. It is based on a simplified version of DeFi that has three main components: a loan or asset supplier, a borrower, and a possible payback arrangement. A BNPL contract, for instance, would be comparable to a secured loan in that it would include a principal amount, collateral, length, and terms, but the interest rate would normally be 0%. As a whole, the standard would outline such comprehensive and all-encompassing methods for successfully defining DeFi contracts. By having a uniform form that is followed by all users of the standard, it will be possible to make existing DeFi and traditional finance contracts more portable, theoretically transferable, and easily traded as collaterals.

Future plans for DeFi

Assets must have some use. They must also offer incentives to people who use them. These structures have been a key driver of growth and development in human societies when they correctly match those with financing with those who need funding (who are also able to use resources effectively and pay back resource suppliers).

These structures power enterprise and small firms, finance trade, mortgages, and housing needs, and they influence every aspect of any economy. More people tend to be lifted out of poverty in societies that have developed more effective methods of finding borrowers with lower default rates, using credit scoring and other algorithmic techniques, including even AI.

Decentralized finance holds the potential to reach millions of people who aren’t currently served by the conventional banking and financial systems. If DeFi moves past its early iterations, which concentrated more on products with phony returns that weren’t supported by any actual value creation by borrowers and relied more on just generating unbacked tokens, this potential will have a better chance of being realized.

When used in the construction of ethical and well-researched contracts and products, standards development and use will work as a catalyst for DeFi’s growth.

Related

Dash 2 Trade – High Potential Presale

- Active Presale Live Now – dash2trade.com

- Native Token of Crypto Signals Ecosystem

- KYC Verified & Audited

Join Our Telegram channel to stay up to date on breaking news coverage