Helium, Kadena, RGT, Nervos, Chiliz Surge to Fresh Highs Amid Market Dip; 3 Reasons To Be Bullish on BTC and Altcoins?

Bitcoin and the majority of Altcoins saw price declines on Nov. 6 as traders reacted to the passage of a $1T infrastructure bill with crypto tax for Biden’s approval.

The pullback in Bitcoin and Ethereum pushed a majority of Altcoin tokens into the red. There are, however, a few outliers in the market. Helium (HNT, +14.30%), Kadena (KDA, +21.51%), Rari Governance Token (RGT, +30.14%) climbed to fresh all-time highs on Nov. 6 while Nervos Network (CKB, +31.42%), Chiliz (CHZ, +19.47%), XYO (XYO, +15.11%), OriginTrail (TRAC, +25.45%), LCX (LCX, +35.40%), Wilder World (Wild, +15.50%) were significantly up in the last 24 hours.

The rise in the price of KDA to all-time highs of $13.82 on Nov. 6 comes as Kadena marks the fourth consecutive day in the green after resolving a bullish pennant. A revamp of the projects website contributes to the positive sentiment as well as the upcoming arrival of Wrapped KDA on Ethereum.

”Soon you’ll find Wrapped $KDA on an Ethereum-based #DEX near you! Along with bridging to ETH, @kadena_io is committed to expanding to other layer-1 protocols such as @terra_money, @Polkadot, @CeloOrg, @cosmos, & more!”.

CHZ is the native asset of Chiliz which also powers the socios fan engagement app. The recent increase in CHZ price follows up the massive spike seen in late October after Chiliz disclosed it had deployed the beginning of its NFT strategy. Announcing the debut of the AC Milan NFT drop, it says The AC Milan launch will be the first of many similar launches to be held with our 100+ strong roster of partners”.

Rari Governance Token (RGT) is the native asset of Rari Capital, a DeFi protocol that allows users to borrow, lend and earn yields on crypto assets. Rari surged to fresh highs of $61.76 on Nov. 6 following the news of its Binance Listing.

Nervos Network (CKB) rose to fresh highs of $0.03 on Nov. 6 following the debut of the mainnet beta layer-two blockchain project, Godwoken. Other community-based projects scheduled for release in the coming months such as YokaiSwap adds to bullish enthusiasm.

Helium (HNT) has ticked higher since November’s start, marking the fifth consecutive day in green to reach all-time highs of $39.10 today. In late October, Helium announced a new partnership with Dish Network, which will further extend its 5G network in exchange for HNT rewards.

3 Reasons To Be Bullish on BTC and Altcoins?

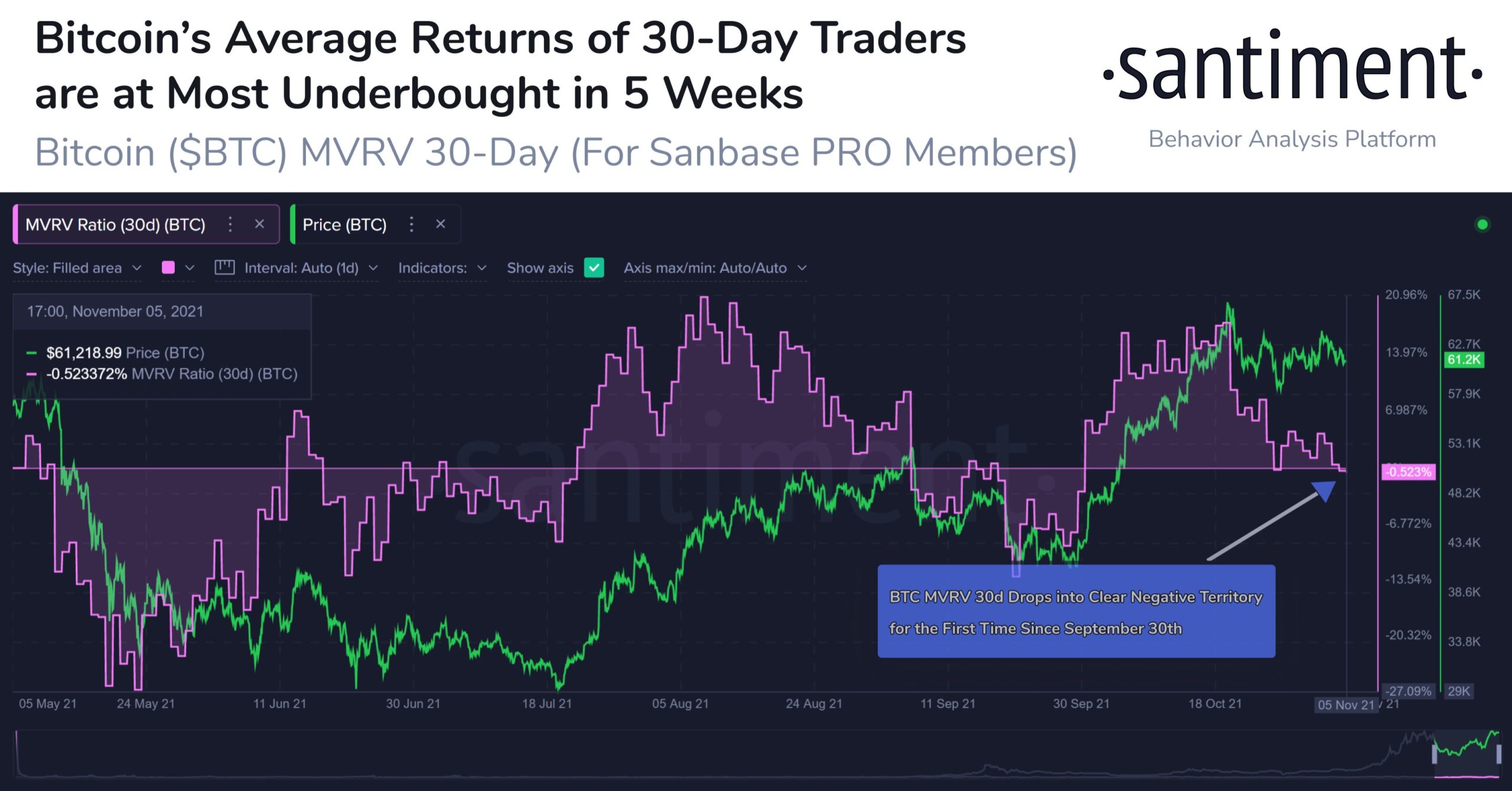

1. Metrics From On-Chain Analytics, Santiment Indicate Bitcoin Is Yet Underbought.

”#Bitcoin’s 30-day MVRV, measuring the returns of 30-day trading addresses, indicates that it’s crept into negative territory for the first time since September 30th. For #bulls, this is a great sign, indicating a mild signal of $BTC being underbought”.

Courtesy: Santiment

Courtesy: Santiment

2. Stock To Flow Creator, PlanBwhose prediction of Bitcoin’s monthly closes since August has fallen in line believes a 60% jump for Bitcoin price is not farfetched based on historical context. ”Some people think Nov. close $98K is too big a jump. It is +60% from the current level. Yes, that is a big jump. But #bitcoin did this many times before, May 2019 +62%, Aug 2017 +66%, May 2017 +66%, Nov 2013 +451%, Oct 2013 +61%, Mar 2013 +181%, Feb 2013 +63%”

Other analysts are confident that Bitcoin’s next breakout will push its price above $80,000, probably towards $90k. On-chain data source Ecoinometrics data suggests that if the current cycle follows the same pattern as in 2017, the next BTC price peak could be as much as $253,800.

3. Positive Correlation Between the Traditional Markets and the Crypto Market. November traditionally sees strong gains for United States stocks. Data also indicates that November has been the best performing month for the S&P 500 since 1985.

Will Morris, a trader at GlobalBlock says Historically, there has been a slightly delayed positive correlation with traditional markets and the crypto market, helping to build the case for a bullish November for digital assets.”

Image Credit: Shutterstock