ETC Prolongs its Ranging Moves

Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum Classic (ETC) Price Prediction – September 14

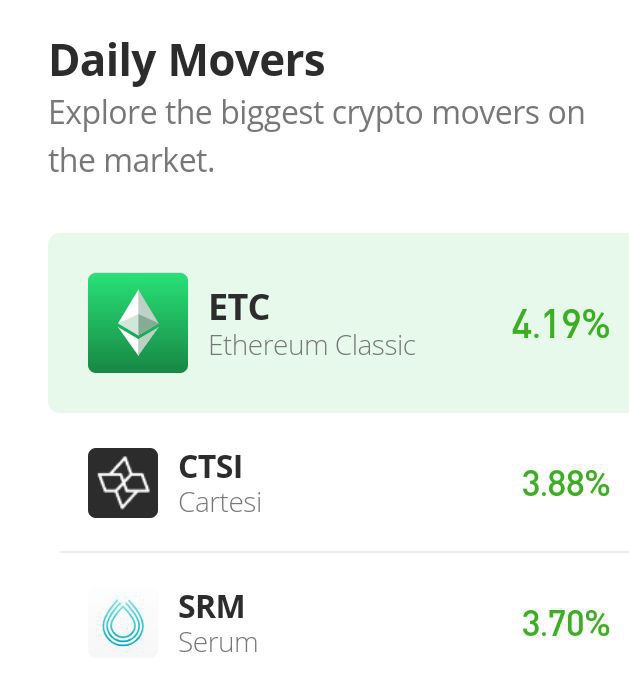

Not much has surfaced to suggest changing the mode of trading operations in the Ethereum Classic market as the crypto prolongs its ranging moves at a high zone against the worth values of the US Dollar over time. The last thirty days of business transactions have produced low and high-value points of $30.55 and $42.33 at an average rate of 4.51 positive.

Ethereum Classic Price Statistics:

ETC price now – $36.91

ETC market cap – $5.1 billion

ETC circulating supply – 136.9 million

ETC total supply – 210.7 million

Coinmarketcap ranking – #17

ETC /USD Market

Key Levels:

Resistance levels: $45, $55, $65

Support levels: $35, $30, $25s

ETC/USD – Daily Chart

ETC/USD – Daily Chart

The ETC/USD daily chart portrays the crypto-economic price prolonging its ranging moves around a high-trading spot over a long session. The 50-day SMA indicator is lying somewhat flat toward the east direction, maintaining the value point at $31.25, underneath the trend line of the 14-day SMA, which is at $35.83. The horizontal line drew at the $35 support level to mark the critical baseline against any possible drawdown in an ugly situation afterward. The Stochastic Oscillators have curved southbound from the range of 80 to 56.91 and 44.83 range values.

Buy Ethereum Classic Now

Your capital is at risk.

Will the ETC/USD market downsize further through some points at the high-trading range spot?

Presently, a bullish candlestick has been beefing to possibly decimate the free downsizing process of the ETC/USD market through some points at the high-trading range spot as the crypto economy prolongs its ranging moves over time. Buyers eagerly intending to execute a position at all costs ought to have monitored the slight rebounding course over some hours back on a lower time frame for easy observation before the current trading price a bit over the trend line of the 14-day SMA’s value point.

On the downside of the technical analysis, a pull-up has been taking the prevalence of the market direction currently. Therefore, there is a need to suspend the opening of a new set of selling orders for now. Short-position placers may psychologically set a sell limit order between the values of $40 and $50 pending the time the market may push within those points for a touch or retest of a previous high line before tending to return to a downward motion afterward.

ETC/BTC Price Analysis

Ethereum Classic has concurrently kept trading at a high-trading spot against Bitcoin over a long period of sessions. The cryptocurrency pair price prolongs its ranging moves around the trend line of the smaller SMA. The 50-day SMA indicator is below the 14-day SMA indicator. The horizontal line drew closely below the smaller SMA to mark the bottom trading arena price has been making some upward swings. The Stochastic Oscillators are in the oversold region, trying to cross northbound from the range values of 9.29 and 11.44. That shows the flagship counter crypto may still have to suffer pushing against its base crypto.

Tamadoge – Play to Earn Meme Coin

- Earn TAMA in Battles With Doge Pets

- Capped Supply of 2 Bn, Token Burn

- NFT-Based Metaverse Game

- Presale Live Now – tamadoge.io

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage