Bitcoin and Ethereum remain stuck in sideway trade, Grayscale Bitcoin Trust continues to plummet

Bitcoin continues to experience low trading volumes amid depressed investor sentiment, however the benchmark cryptocurrency did manage to add around 2% in the last trading session to close at US$17,300.

A small correction this morning set bitcoin back to US$17,200 when the bears stepped in, while further sell walls remain pitched at US$17,400 and US$17,500.

Bitcoin (BTC) faces a sustained range trade around the US$17,000 price point Source: currency.com

Ethereum (ETH) closed Thursday 4% higher at US$1,280, and has so far managed to hold onto those daily gains. The bulls face resistance at US$1,320.

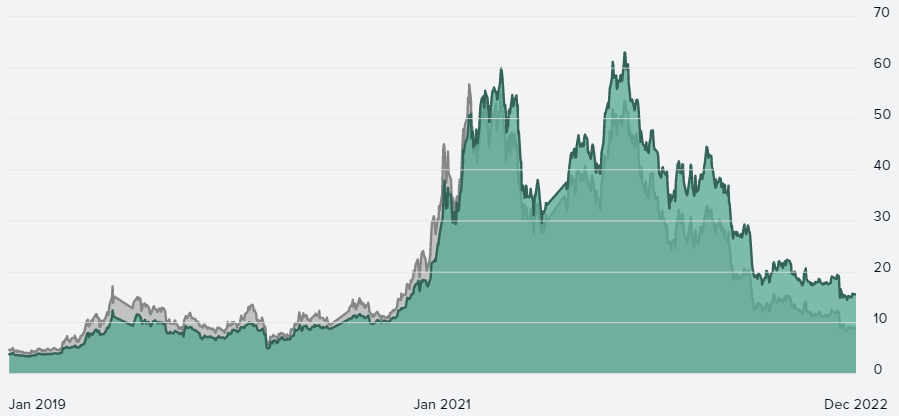

Grayscale Bitcoin Trust (GBTC), the largest investment vehicle of its kind, remains heavily compressed, having reached a near50% discount to the trusts underlying assets.

Grayscale is suffering from bearish sentiment following the FTX collapse, when its sister company Genesis Global Trading faced insolvency fears.

GBTC shares (dark green) remain heavily discounted to the price of the underlying bitcoin asset (light green) Source: grayscale.com

There were few surprises in the large-cap altcoin space, though Polygon (MATIC) enjoyed a 3% run over the past day to bring its market value above US$8bn.

Cardano (ADA), Polkadot (DOT), BNB and Litecoin (LTC) all followed the general direction of the global market, which currently has a market capitalisation of US$860bn.

Layer-2 solution Optimism (OP), which is used as a scaling solution for the Ethereum blockchain, is up nearly 10% following a noticeable uptick in the networks user base.

Optimisms market cap is now close to US$260mln.

Other top risers this morning include Cartesi (CTSI) and Ocean Protocol.

Looking across the week, Axie Infinitys AXS token was the top riser, having added 17%, with Trust Wallet Token (TWT) coming in second.

Among the poorest performers were the decentralised finance (DeFi) protocol 1inch Network, internet-of-things (IoT project Helium (HNT) and oracle network Chainlink (LINK).

Total value locked across all DeFi protocols rose 1% to US$42.4bn over the past seven days.