A Quantified Look At The Monetization Of Bitcoin

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Realized Market Capitalization Trends

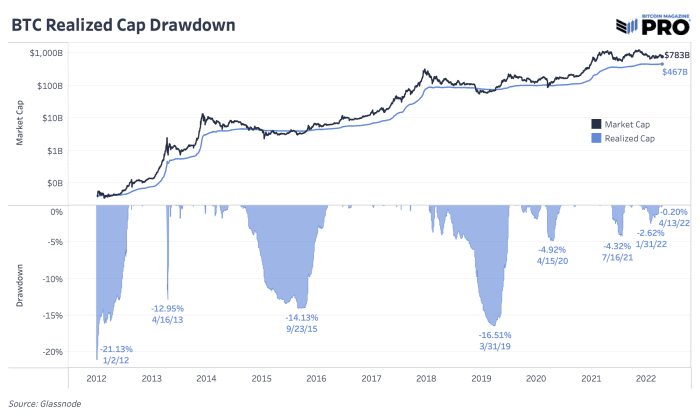

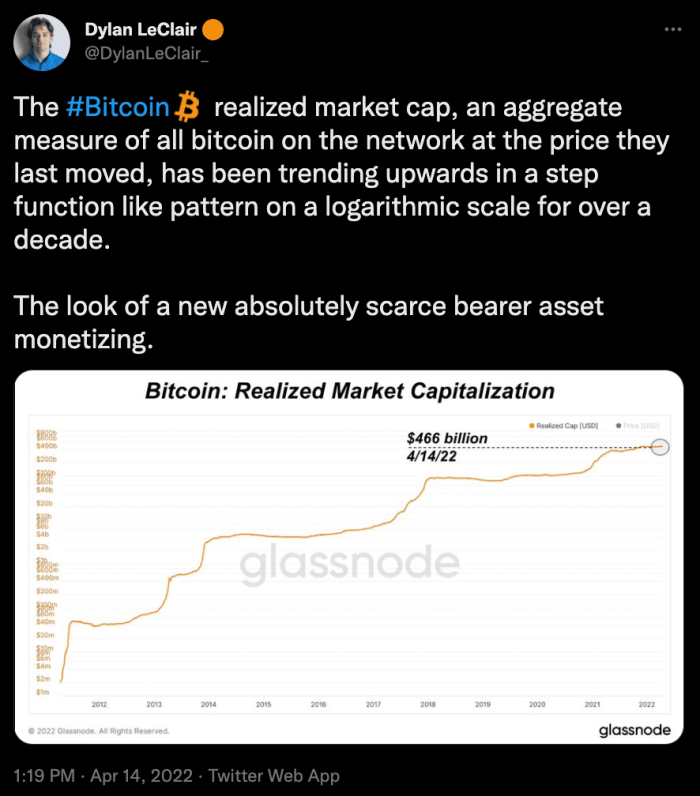

Today, we’re providing an in-depth breakdown of realized market capitalization. Traditional asset classes along with bitcoin itself are often quoted in terms of their market capitalization, which is calculated by finding the product of price and circulating supply. With bitcoin, and the introduction of a completely transparent set of property rights, you can calculate the realized market capitalization, which values each unit of supply at the price it was last moved across the network.

The realized market capitalization of bitcoin is one of the best ways to quantify the monetization process of the asset, as the infamous volatility of the asset is seemingly only occurring to the upside. The fluctuations in the exchange rate are not nearly as volatile as the gradual-then-sudden appreciation of the realized market value of the asset.

(Source)

The realized market capitalization of bitcoin is one of the best ways to quantify the monetization process of the asset, as the infamous volatility of the asset is seemingly only occurring to the upside. The fluctuations in the exchange rate are not nearly as volatile as the gradual-then-sudden appreciation of the realized market value of the asset.

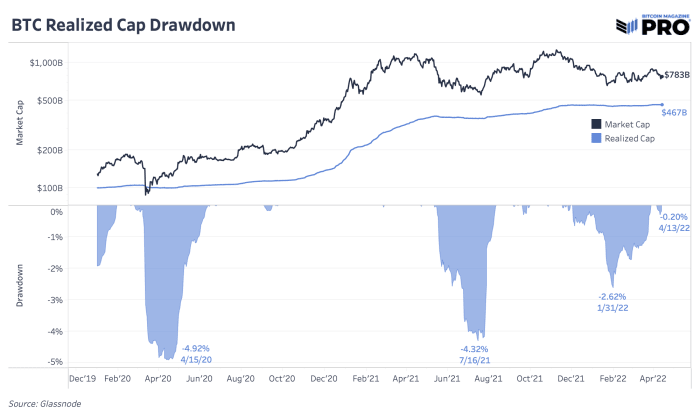

Currently the realized cap of bitcoin is $467 billion, a mere 0.20% off of its all-time high. Despite falling by more than 50% off of the highs since November, the realized market value of bitcoin has only fallen from peak to trough by 2.62%.

A thread written in December 2021 covers this dynamic extensively, citing the patterns of realized price during bitcoin market cycles.

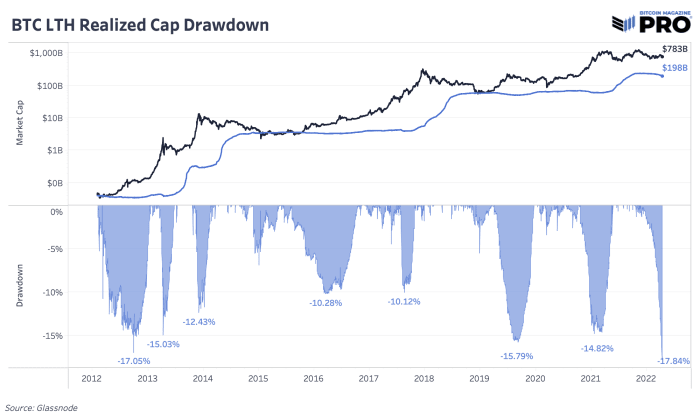

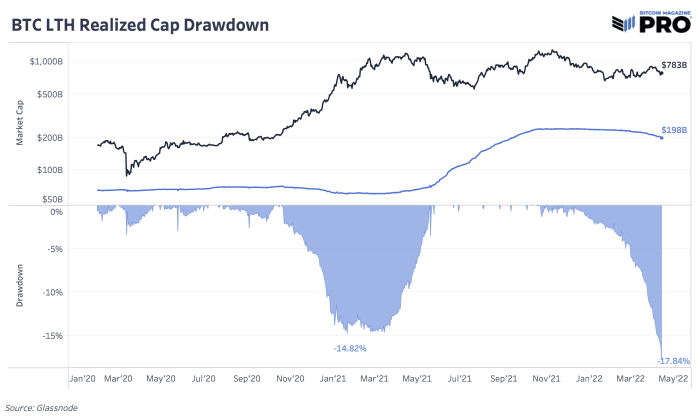

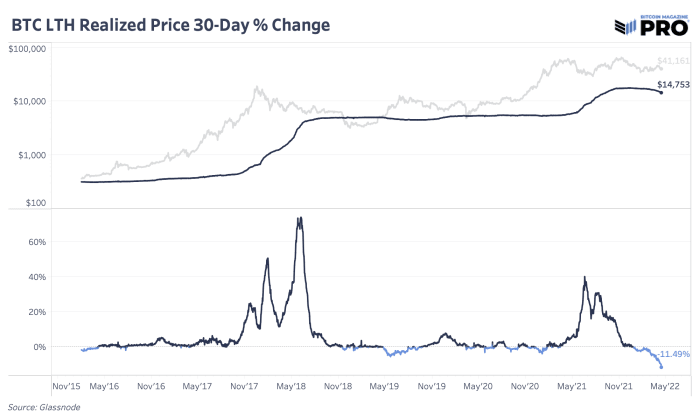

We can also break down realized capitalization into different cohorts including long- and short-term holders. Under the surface, we’re seeing the largest drawdown in long-term holder realized capitalization in bitcoin’s history.

Although long-term holder supply is fairly neutral since the start of the year, up 0.6% as accumulation and coins aging into this group continues, the data shows that there’s been plenty of selling too. Long-term holders realized capitalization and realized price falls as coins with higher cost basis are sold. This lowers the overall average cost basis which is down 11.49% over the last 30 days.

With this data and the process by which long-term holders are quantified, the class of 2021 holders that recently aged into the cohort are the ones moving their holdings.

Re-accumulation has been our base case since the start of Q1 2022, and the state of these metrics continue to support that market outlook despite the recent rise in long-term holder selling pressure.