A Guide to Cryptos Disconnect Between Fundamentals and Speculation

Gone are the days when crypto was considered to be something purely speculative, lacking in fundamentals. Retail and institutional investor interest and involvement in the last 12 months has proven that its a space to be taken seriously. However, now there seems to the opposite problem — the fundamentals of crypto are established and strong, but the speculative interest has disappeared, according to Matt Hougan, CIO of Bitwise, in a recent letter to investors.

Even a year ago, if a major financial firm had announced inclusion of cryptocurrencies in its retirement plans, crypto prices would have spiked, but when Fidelity announced the inclusion of bitcoin in 401(k)s, bitcoin and crypto in general traded down.

This story has repeated multiple times of late. From the Biden Executive Order to the planned Ethereum upgrade, crypto has made incredible progress across many measuresregulatory, venture capital, developer activity, overall adoption, and moreand yet crypto prices have been lackluster in 2022, Hougan writes.

The Case for Crypto Fundamentals

There are a number of factors that demonstrate the strength of the fundamentals within crypto, which include thriving venture capital funding; VC contributions to crypto-related firms were $14.7 billion in Q1, a growth of 230% year-over-year. Last year saw VC contributions of $30.5 billion, a total that tops the entire decade between 2010-2020 combined.

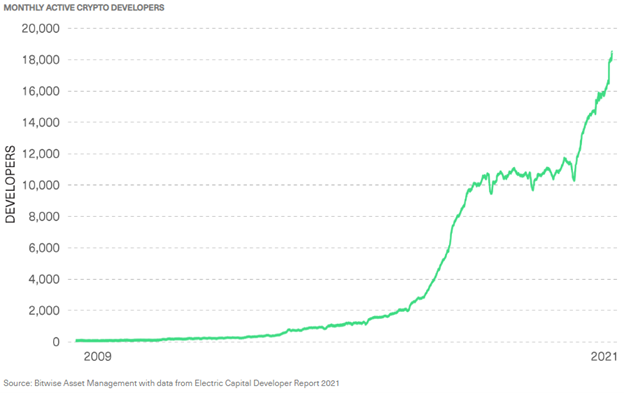

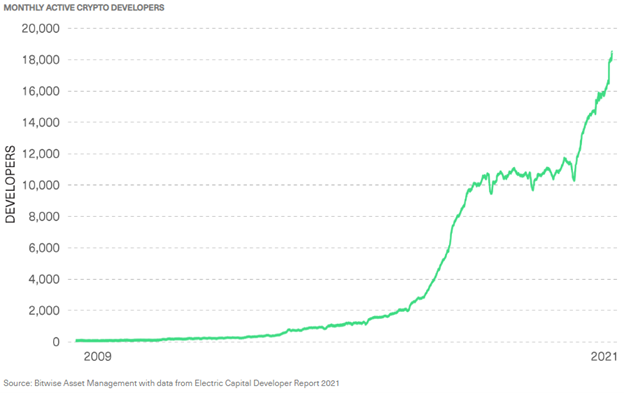

Developers have continued to pour into crypto as well, with the number of developers working within crypto on crypto-related protocols at the highest it has ever been. The increased involvement of more software engineers is being seen in the growth happening on the blockchains as practically every large blockchain is undergoing massive upgrades to its capabilities.

Image source: Bitwise

The pace of progress is staggering, Hougan explains. Ethereums Merge due this summer is a major example, but other updates include Polkadots technical roadmap and Bitcoins Taproot upgrade.

Regulation across the globe has also shifted in regard to crypto in the last year, particularly within the U.S. The focus has changed from targeting the bad actors to instead balancing investor protections and regulations with innovation protections. From President Bidens executive order regarding crypto, to U.S. Treasury Secretary Janet Yellens speech on digital assets, to the nomination of a crypto advocate for the Fed Vice Chairman for Supervision (Michael Barr, former Ripple Adviser and currently the public policy school dean at the University of Michigan Law School) the crypto regulatory tides are changing in the U.S.

Why Crypto Is Underperforming Its Fundamentals

Crypto has proven to be highly susceptible to the macro environment, particularly when the macro news lends itself to a risk-off environment. In a market that is currently focused on rising interest rates, inflation, and the potentials for recession, investors have become extremely risk-averse, particularly in recent days.

Crypto is a classic risk asset. It is highly volatile, and much of its value stems from expectations about its future importance. During risk-off markets, the market discounts that future value and crypto trades down. When the risk-off factor is strong, this can overwhelm the fundamentals, explains Hougan in the letter.

When considering crypto, particularly in challenging market environments such as today, Hougan reminds investors that despite the price performance, the fundamentals are still strong, that progress is still being made, and that developers, venture capitalists, and regulation are still creating positive momentum.

It may take months, or even quarters, for the markets broad risk-off instinct to moderate and for this undercurrent of steady progress to become reflected in prices. There could be a lot of volatility in the meantime, too. But as we assess the moment, crypto increasingly feels like a tightly loaded spring, Hougan writes. Eventually, prices will catch up with the fundamentals, and that will be a very interesting moment indeed.

Bitwise offers theBitwise Crypto Industry Innovators ETF (BITQ), theBitwise 10 Crypto Index Fund (BITW), and a host of other crypto funds focusing on various aspects of the crypto economy.

For more news, information, and strategy, visit theCrypto Channel.