5 DeFi Metrics Surging Post-FTX

Have you heard about the Bankless Token Bible?

Its a living document that we update every month with up-to-date analysis on dozens of tokens and protocols.

The whole point is to make it as easy as possible for our Premium members to stay on top of the Bankless takes on what tokens to buy, hold, or sell (for entertainment purposes only).

Not already a Bankless Premium member? Upgrade now to get immediate access.

Dear Bankless nation,

SBF is in handcuffs and the holidays are just around the corner. Despite the good tidings, its been a rough quarter for the crypto industry and most of our bags.

This week, we take a look at DeFi metrics that have been up-only since the FTX implosion. Follow along as we extrapolate what these trends could mean for crypto and your future strategies.

– Bankless team

Bankless Writer: Jack Inabinet, Bankless Intern

Where is capital flowing in a post-FTX world? Curious about which projects have benefited from the FTX collapse? Searching for the light in the depths of crypto doom and gloom?

Then youve come to the right place!

Today, well unpack the answers to your questions, anon: just read on

Rule #1: NOT YOUR KEYS, NOT YOUR CRYPTO!

It’s amazing how many people finally grasp the value of this core crypto tenet after a major catastrophe occurs. Too bad there is not readily available data on Ledger Nano sales because its certainly up only as well!

Exchanges have seen a net outflow of $4.675B in stablecoins since November 4, an 11.4% decrease in exchange stablecoin balances.

Additionally, net Ether outflows from exchanges over the same period totaled $5.125B, representing 13.1% of total ETH previously held on CEXs.

Since November 4, $9.8B in stables and Ether has been withdrawn from CEXs.

With widespread Binance insolvency fears circulating CT, it is unlikely this trend of withdrawals will reverse anytime soon.

Todays most sophisticated auditing solutions do little to reassure users of the safety of their assets on CEXs:

Reversing capital flight will require exchanges regain the trust of their customers, which is likely a difficult task at a time when crypto market participants are (rightfully) more suspicious of centralized custodians than ever.

Just because FTX collapsed doesnt mean that cryptos thirst for leverage was satiated: GMX was a major beneficiary of CEX outflows from DeFi users looking to access a trustless trading experience.

It offers users up to 30x leverage, considerably higher than many DeFi protocols

Few established crypto projects have higher TVLs today than they did at the start of November. USD-denominated TVL for GMX is up 9.9% from November 5.

When denominated in ETH, GMXs TVL is up 41.0% since November 5!

Mayhem and cascading insolvencies following the FTX fiasco erased value throughout the crypto ecosystem. Because of this, viewing TVL in terms of ETH can provide a more accurate proxy for a given protocols growth in crypto market share.

For example, as GMXs USD-denominated TVL fell 25.3% from November 5 to 10, while its ETH-denominated TVL rose by 12.1%!

Temporary decreases in GMXs USD-denominated TVL were direct results of systemic corollary factors (i.e., risks not unique to the Protocol). Increases in ETH-denominated TVL indicate a greater percentage of crypto assets made their way onto the platform during this period, increasing market share.

Currently, GMX TVL is up, in terms of both USD and ETH, signaling that the platform has become a preferred choice for traders looking for decentralized alternatives to centralized exchanges.

GMX comprises over half of Arbitrums TVL. With this framing in mind, it is not shocking that Arbitrums TVL has been up only post-FTX.

What is shocking is that Arbitrums TVL, exclusive of GMX, has increased 7.6% from its pre-FTX high set on November 5.

Why is this shocking?

Lets just say Layer 2 TVL recovery has been a little less ~optimistic~ when compared to Arbirtum: L2 USD-denominated TVL is 16.6% off its November 5 high.

High fee revenue from GLP has turbocharged the Arbitrum ecosystem, boosting TVL. Yields generated from the assets fee structure serve as the backbone for the chains economy.

Arbitrum developers depend on high GLP yields!

Umami Finance, for example, is working towards launching vaults that hedge price risk for GLP, while continuing to provide users with the associated high yield.. Higher yields on GLP make this vault, and by extension the dApp, more attractive to DeFi users. Projects on Arbitrum benefit from deeper liquidity and bolstered valuations when GMX yields are attractive.

The significance of yield earned on GLP to the ecosystem is evident in the resilience of the Arbirtums TVL to post-FTX drawdowns seen by competitive L2s.

Sentiment and Gearbox launched on October 21 and 23, respectively, and appear primed to prove that this bear market is a build market!

Both protocols allow users to access juiced yields on whitelisted DeFi protocols, via the aid of undercollateralized leverage (for more information on these protocols, check out The Ultimate Guide to Undercollateralized Lending in DeFi).

The launch of these protocols, Gearbox in particular, was a positive catalysts for the sectors TVL, which grew from $11.4M on October 23 to $119.9M on November 5 an increase of 952%!

Unfortunately, the collapse of FTX slammed the brakes on the rapid TVL growth displayed in the leveraged farming sector and contributed to the segments observed 20.3% peak-to-trough TVL drawdown. While the sector had yet to gap-up to November 6 ATHs at the time of analysis, it was within 1% on December 13, with $118.9M in TVL.

High TVL seen is likely unsustainable in the leveraged farming sector over the long-term. Gearbox represents 94% of the sectors TVL and HEAVILY subsidizes its yields!

The Protocol rewards lenders with up to 6.66% APY in GEAR rewards on select pools to incentivize deposits.

Diluting holders via token incentives is not a viable long-term strategy. While acquiring new users is essential to protocol success, failure to retain current users decimates a protocols community and can jeopardize the future of the project.

Capital has flown into the leveraged farming sector because Gearbox, in particular, is a shiny new toy with token incentives attached. Unwinding these programs may result in TVL drawdowns for the sector.

Did someone say collectible?

Starbucks did! They just opened the Starbucks Odyssey to beta testers.

Redditooors did, too. The number of unique Reddit Collectible Avatar holders has increased by 50% since November 5th.

In an industry flush with declining user counts and falling levels of on-chain activity, Polygons expansion into the branded collectible market has proven surprisingly successful. Mints, transfers, and sales of these low-value collectibles have mooned NFT activity on Polygon.

Over 84k returning users purchased a Polygon NFT on OpenSea December 12, an increase of more than 630% from November 5!

Additionally, the number of weekly OpenSea users and NFT minters increased by 178% from the week ending November 7: almost 245k Polygon addresses performed one of these actions over the past week.

While these NFT projects masquerade under the guise of collectibles in an attempt to dissociate themselves with cryptos perceived toxic culture, their success remains a testament to the viability of the NFTs and provides encouragement that corporates are moving to adopt and integrate blockchain technologies in their business models and loyalty programs.

Practically everything is down right now.

Practically everything was down after 3AC blew up.

Practically everything was down after the Fed raised rates.

Practically everything was down after COVID became serious.

Practically everything was down after the Chinese stock market crashed in 2015.

Practically everything was down after the American housing market exploded in 2008.

I could go on and on I think I missed some events in between. The numbers on the screen go up and down, but the primitives that crypto is building are here to stay. We are building for the future we want.

Generate alpha and prepare for the next narrative. Will self-custody, DeFi, innovative fee structures, and branded communities make the cut? How does yield intersect with growth for crypto?

Stick around and find out, anon.

-Jack

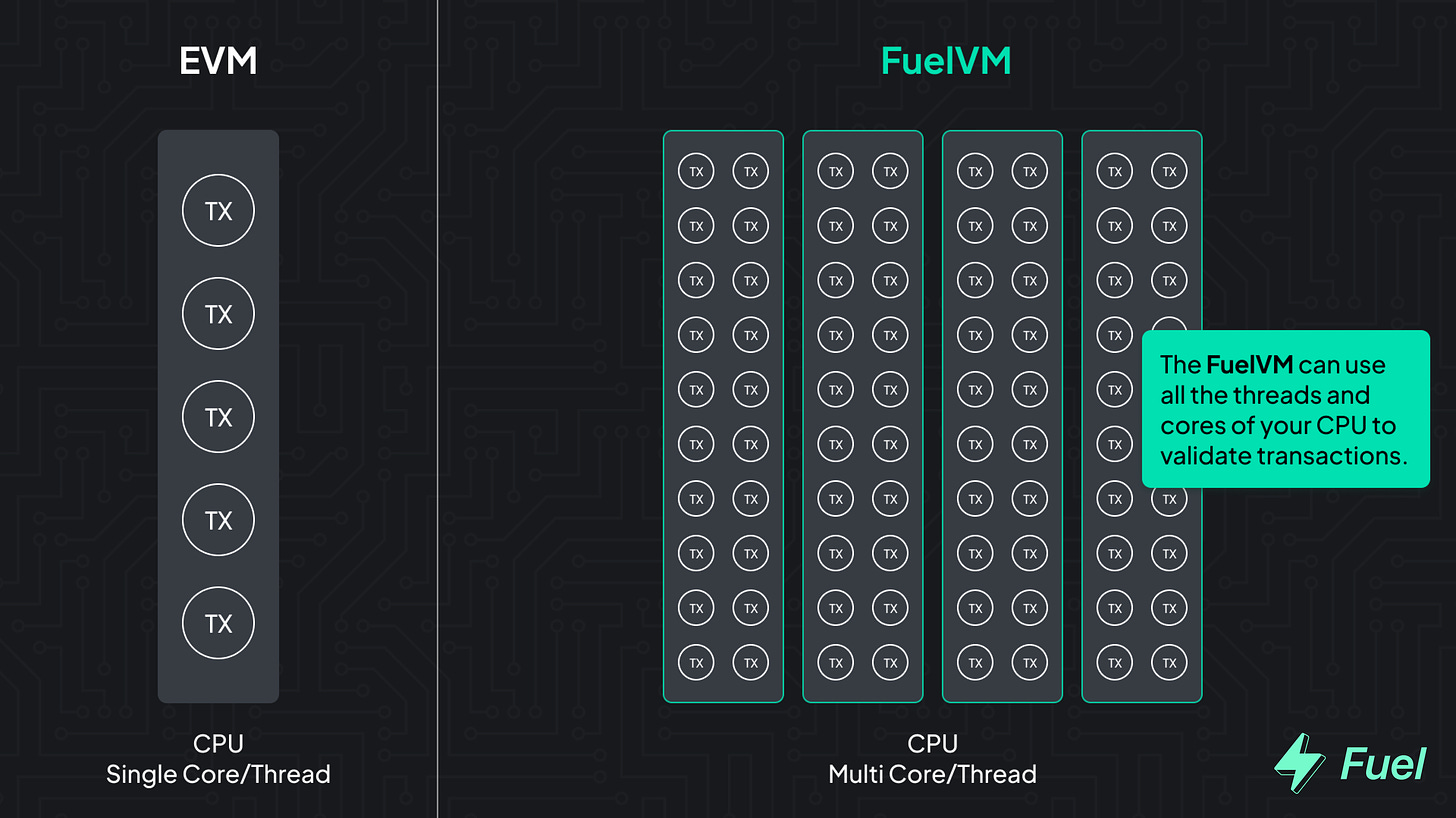

Modular blockchains are the future. L2s alone wont solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

Go beyond the limitations of the EVM: explore the FuelVM

Jack Inabinet is an intern at Bankless. Prior to working at Bankless, Jack was a Commercial Real Estate Analyst at HAL Real Estate. Hes currently studying Business & Finance at the University of Washington and has been involved in crypto for 2+ years.

Subscribe toBankless. $22 per mo. Includesarchive access,Inner Circle&Badge.

Explore the FuelVM and discover its superior developer experience!

Not financial or tax advice.This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.